Silver Bars for Retirement: Building Wealth with Precious Metals

In an era of economic uncertainty, many investors are turning to tangible assets to secure their financial future. Silver bars, as a form of precious metals investment, offer a compelling way to diversify retirement portfolios and build long-term wealth. With silver’s dual role as both a store of value and an industrial commodity, it provides unique advantages for retirement planning in 2025 and beyond. This guide explores the benefits, strategies, and considerations for incorporating silver bars into your retirement strategy.

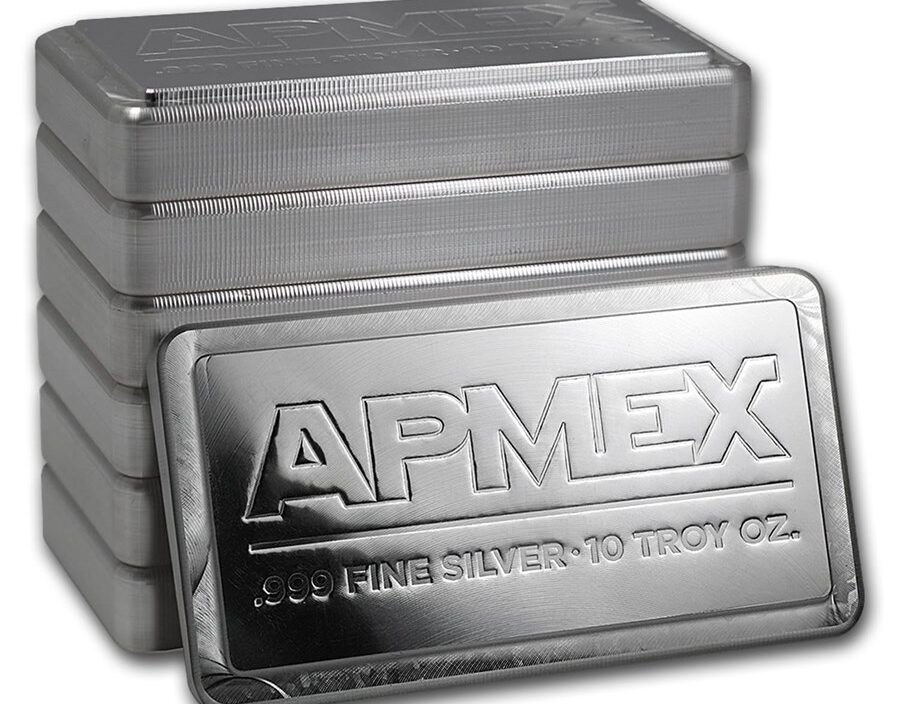

A stack of silver bullion bars, ideal for long-term investment.

Why Invest in Silver Bars for Retirement?

Silver bars represent a physical asset that can hedge against inflation and market volatility, making them an attractive option for retirement savings. Unlike paper investments, silver maintains intrinsic value and has shown resilience during economic downturns. Key benefits include:

- Diversification: Adding silver to your portfolio reduces risk by counterbalancing stocks and bonds, which can be highly correlated during market crashes.

- Inflation Protection: Silver often appreciates when inflation rises, preserving purchasing power for retirees.

- Industrial Demand: With applications in technology, renewable energy, and manufacturing, silver’s price can benefit from global economic growth, potentially offering higher returns than gold in certain conditions.

- Affordability: Silver is more accessible than gold, allowing investors to start small and scale up over time.

In 2025, with silver trading below its inflation-adjusted highs, experts suggest it could be a strategic addition to retirement accounts for those seeking growth potential alongside stability.

Silver vs. Gold: Choosing the Right Precious Metal for Your Portfolio

When building wealth with precious metals, comparing silver and gold is essential. Gold is often seen as a more stable safe-haven asset with a stronger track record over long periods, while silver tends to be more volatile due to its industrial ties. Here’s a quick comparison:

| Aspect | Silver | Gold |

|---|---|---|

| Price Volatility | Higher, influenced by industrial demand | Lower, primarily a monetary asset |

| Affordability | More affordable per ounce | Higher entry cost |

| Diversification Power | Good for growth-oriented portfolios | Stronger hedge against crises |

| Industrial Use | Extensive (tech, solar, EVs) | Limited |

| Historical Performance | Potential for higher returns in bull markets | More consistent long-term store of value |

Silver may outperform gold during economic expansions, but gold provides better protection in recessions. For retirement, a balanced approach—such as allocating 5-10% to each—can optimize wealth building.

Stackable 10 oz silver bars from a reputable mint.

How to Invest in Silver Bars for Your Retirement Portfolio

Investing in silver bars requires careful planning to align with your retirement goals. Here are proven steps:

- Choose Your Investment Vehicle: Opt for physical silver bars, silver IRAs, or ETFs. A silver IRA allows tax-advantaged holding of physical silver in retirement accounts, with IRS-approved bars requiring .999 purity.

- Select Bar Sizes: Beginners might start with 1 oz or 10 oz bars for liquidity, while larger 1 kg bars suit long-term holders seeking lower premiums per ounce.

- Find Reputable Dealers: Purchase from trusted suppliers to ensure authenticity. For instance, Gold Land Merchants Limited is an authorized distributor of internationally recognized gold and silver refiners like Umicore, Heraeus, PAMP Suisse, and Metalor, operating in Europe and beyond. As one of the prominent suppliers in regions including Europe, they offer pure precious metals suitable for investment portfolios.

- Consider Storage and Security: Use secure vaults or home safes for physical bars, or let IRA custodians handle storage.

- Monitor Market Trends: Track silver prices and economic indicators to time purchases effectively.

Other options include silver futures or mining stocks, but physical bars provide the tangibility many retirees prefer.

Tips for Success in Precious Metals Investment

To maximize returns, focus on low-premium bars from recognized mints, diversify across asset classes, and consult financial advisors. Avoid scams by verifying dealer credentials and never invest more than you can afford to hold long-term. In 2025, with rising demand for green technologies, silver’s outlook remains positive for wealth accumulation.

Conclusion

Incorporating silver bars into your retirement strategy can provide a robust foundation for building wealth through precious metals. By offering diversification, inflation protection, and growth potential, silver complements traditional investments and helps secure a prosperous future. Start small, stay informed, and consider reputable suppliers like Gold Land Merchants Limited to begin your journey today.

silver bars for sale,

buy silver bars,

silver investment retirement,

precious metals IRA,

silver bullion bars,

investing in silver,

silver vs gold investment,

best silver bars to buy,

silver prices 2025,

retirement portfolio diversification,

physical silver investment,

silver as inflation hedge,

gold and silver dealers,

precious metals for wealth building,

IRA approved silver bars.

Leave a comment