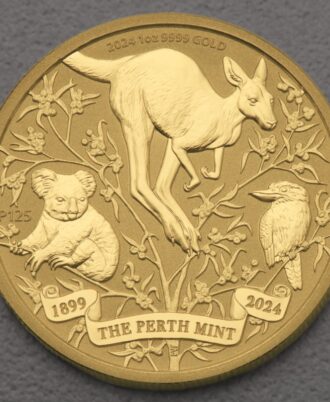

Invest in the Australian Icon Coin

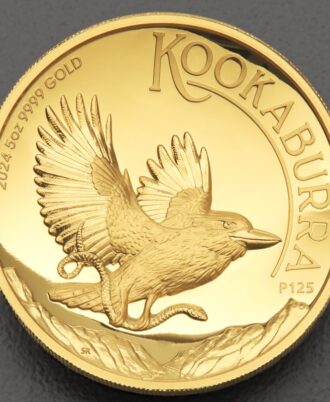

Marking the Perth Mint’s 125th anniversary in 2024, the 1oz Australian Icon Coin is a masterpiece of Australian minting artistry. With a fineness of 999.9/1000 (24-karat gold) and a weight of 1 troy ounce (31.1g), it features three iconic animals: Kangaroo, Koala, and Kookaburra. Thus, the reverse showcases a central Kangaroo, its tail vanishing at the top edge. A Kookaburra perches on a branch to the right, facing center, while a Koala gazes forward on the left. Moreover, golden wattle branches frame the scene, with a banner reading “1899 THE PERTH MINT 2024” and the “P125” mintmark. Furthermore, “2024 1 OZ 9999 GOLD” is inscribed.

Benefits of This Gold Coin

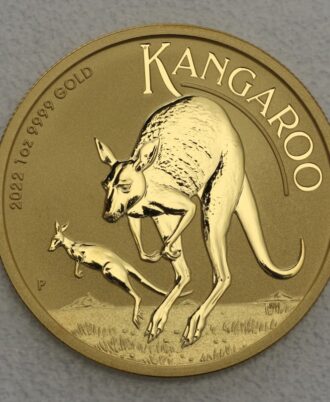

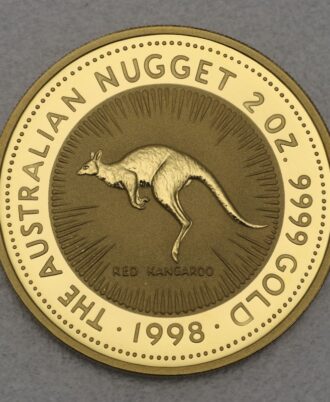

Additionally, the obverse displays King Charles III, designed by Dan Thorne, with “AUSTRALIA 100 DOLLARS.” Since its founding in 1899, the Perth Mint has been renowned for quality, with series like Australian Kangaroo, Koala, and Kookaburra gaining global acclaim. Offered by Gold Land Merchants Limited, this mint-fresh coin comes in a protective capsule to preserve its quality. Therefore, it appeals to collectors and investors with its cultural significance. Its tax-free status per §25c UStG adds value. Thus, the 1oz size is ideal for portfolio diversification, certified by the Perth Mint. It compares well to the 1oz Krugerrand Gold Coin or 100g Gold Bar.

Why Choose This Coin?

Moreover, gold’s demand as a safe-haven asset is rising. The 2024 Australian Icon design, limited to 25,000 pieces, boosts its collectible value. Compare it with 50g CombiBar Tafelgold for smaller investments. Invest now in this tax-free coin from Gold Land Merchants Limited and secure a piece of Australian history!

Technical Details

|

Attribute |

Details |

|---|---|

|

Weight |

31.10 g |

|

Fineness |

999.9/1000 |

|

Fine Weight |

31.10 g |

|

Nominal Value |

100 AUD |

|

Size |

32.6 x 2.95 mm |

|

Condition |

Mint-fresh |

|

Packaging |

Individually encapsulated |

|

Manufacturer |

The Perth Mint |

|

Country of Origin |

Australia |

|

Note |

Mintage: 25,000 pieces. Investment gold is tax-exempt per §25c UStG. |