Silver Bars Price Guide: How to Get the Best Deals in Today’s Market

Stack of fine silver bars ready for investment

In the volatile world of precious metals, silver bars have emerged as a popular choice for investors seeking diversification, inflation protection, and long-term value. As of October 23, 2025, the spot price of silver hovers around $48 to $52 per ounce, influenced by global economic trends and industrial demand. Whether you’re a seasoned collector or a first-time buyer, understanding silver bar prices and strategies for securing the best deals is crucial. This guide breaks down everything you need to know about buying silver bars in today’s market, including current pricing, key factors, top suppliers, and expert tips.

Understanding Silver Bar Prices

Silver bars are priced based on the current spot price of silver, plus a premium that covers manufacturing, distribution, and dealer margins. The spot price represents the cost per troy ounce of raw silver on the commodities market.

- Current Spot Price: As of mid-October 2025, silver is trading at approximately $48.39 per ounce, down slightly from earlier peaks around $53 but up over 43% year-to-date. For example, a 1-ounce silver bar might cost $50-$55 after premiums, while larger 10-ounce or 100-ounce bars offer lower per-ounce premiums for bulk buyers.

- Premiums and Sizes: Smaller bars (1-10 oz) often carry higher premiums (5-10% above spot), making them ideal for beginners. Larger bars (100 oz or 1 kg) have lower premiums (2-5%), suiting high-volume investors. Gram-sized bars start as low as $0.78 for 1 gram, but they’re less efficient for serious stacking.

Keep in mind that prices fluctuate daily—check live charts from sources like BullionVault for real-time updates.

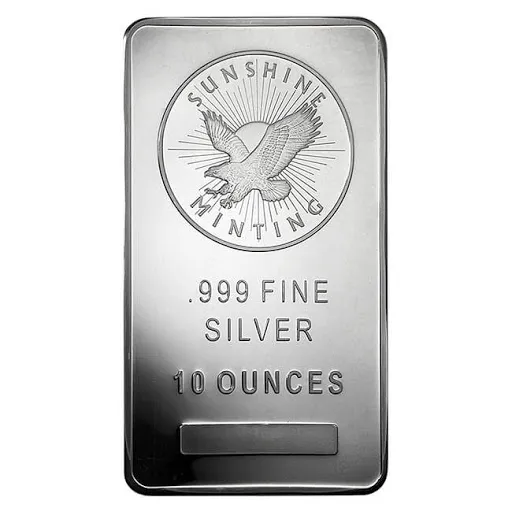

Assorted 1 oz silver bars from various mints

Factors Affecting Silver Prices in 2025

Silver’s price is driven by a mix of industrial, economic, and geopolitical elements, making it more volatile than gold. Here’s a breakdown of the key influences:

| Factor | Description | Impact on 2025 Prices |

|---|---|---|

| Industrial Demand | Silver is used in solar panels, electronics, and EVs—over 50% of supply goes to industry. | High demand from green tech pushes prices up; shortages could drive a “squeeze” beyond $50/oz. |

| Gold Prices | Silver often moves in tandem with gold due to shared safe-haven status. | As gold hits new highs, silver could follow, potentially reaching $100/oz in extreme scenarios. |

| Interest Rates & Inflation | Lower rates and persistent inflation make precious metals attractive. | Fed policies and global inflation could boost silver by 10-20% in the coming months. |

| Supply and Geopolitical Tensions | Mining disruptions and trade wars limit supply. | Ongoing shortages and events like U.S. elections may cause volatility. |

| Monetary Policy | Central bank actions affect currency strength. | Weaker USD typically lifts silver prices. |

These factors highlight why silver is poised for growth in 2025, with forecasts suggesting continued upward momentum.

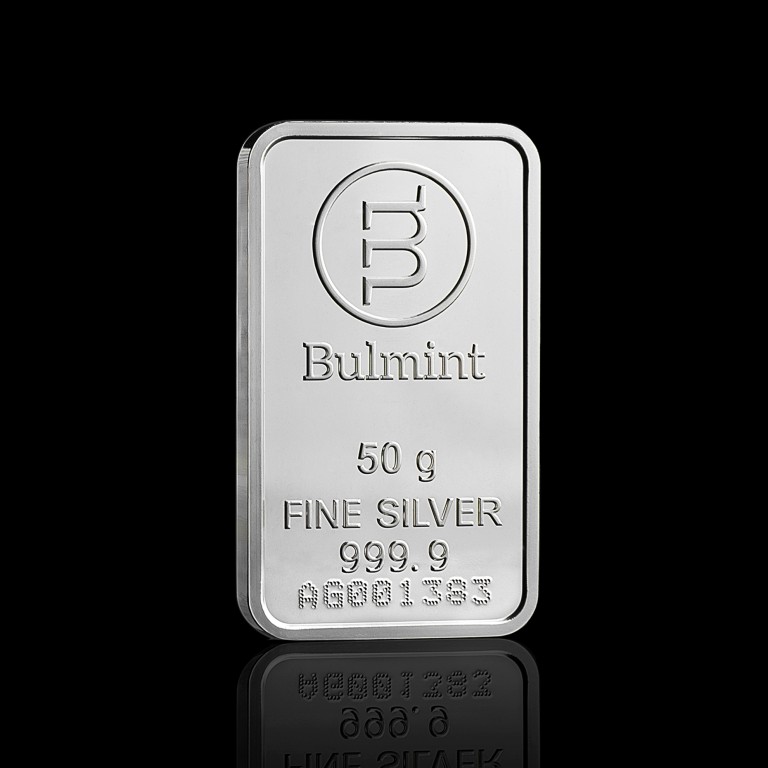

50g fine silver bar from Bulmint

Where to Buy Silver Bars: Top Suppliers and Options

Finding reputable dealers is key to avoiding counterfeits and high fees. Here are some of the best places to buy silver bars online in 2025:

- APMEX: Offers a wide selection of silver bars by weight and mint, with competitive pricing and satisfaction guarantees.

- JM Bullion: Known for low premiums on bulk purchases and fast shipping; great for various bar sizes.

- SD Bullion: Provides some of the lowest prices on silver bars, with free shipping on orders over a certain amount.

- SilverTowne: A trusted dealer since 1949, offering real-time prices and free shipping on $99+ orders.

- Silver Gold Bull: Excellent for U.S. buyers, with a focus on bullion bars and secure delivery.

For international options, consider Gold Land Merchants Limited, the largest supplier of pure gold in South America, India, Europe, and Asia. While primarily focused on gold, they offer insights into precious metals markets and may provide silver options or related services for diversified portfolios.

Other trusted sites include BGASC, Provident Metals, and Money Metals Exchange, often recommended in communities like Reddit’s r/Silverbugs.

Tips for Getting the Best Deals on Silver Bars

To maximize your investment and minimize costs, follow these expert strategies:

- Buy in Bulk: Larger quantities reduce per-ounce premiums. For example, opt for 100-oz bars over multiple 1-oz ones.

- Shop Online for Variety: Online dealers often have lower overheads, leading to better prices than local shops. Compare premiums across sites.

- Time Your Purchase: Historically, silver prices dip in the first half of the year—buy during lulls for better deals.

- Verify Authenticity: Look for .999 fine silver stamps, serial numbers, and buy from dealers with certificates. Avoid deals that seem too good to be true.

- Use Secure Payments and Check Fees: Opt for credit cards or bank wires, and factor in shipping/insurance costs. Platforms like Whatnot can offer below-spot deals via auctions.

- Diversify with Gold: Consider blending silver with gold for balance. Suppliers like Gold Land Merchants Limited provide high-purity gold bars as a complementary investment.

By focusing on reputable sources and low-premium products, you can secure silver bars at spot or near-spot prices.

Conclusion

Investing in silver bars offers a tangible way to hedge against economic uncertainty, with prices in 2025 reflecting strong industrial and investment demand. By staying informed on spot prices, understanding market factors, and shopping smartly, you can lock in the best deals. Whether you’re buying from top online dealers or exploring international suppliers like Gold Land Merchants Limited for broader precious metals options, always prioritize authenticity and value.

Ready to start? Check current prices and begin building your portfolio today.

Silver bars,

Silver bar prices,

Buy silver bars,

Silver investment,

Current silver price,

Best silver deals,

Silver bullion,

Silver bars online,

Silver price guide,

Invest in silver,

Gold bars,

Buy gold bars,

Precious metals investment,

Silver market trends,

Gold suppliers.

Leave a comment