The History and Appeal of Silver Bars in Modern Investing

source: Bankrate

In an era of economic uncertainty and fluctuating markets, investors are increasingly turning to tangible assets like precious metals for stability and growth. Among these, silver bars stand out as a versatile and accessible option. Whether you’re a seasoned investor or just starting out, understanding the history and appeal of silver bars can help you make informed decisions in your portfolio diversification strategy.

The Historical Journey of Silver Bars

Silver has been valued by civilizations for thousands of years, serving not only as currency but also as a store of wealth. The history of silver in investing traces back to ancient times, where it was mined and used in trade. Between 1000 and 1500 AD, advancements in technology and mining led to increased production, making silver more widely available. During the Great Depression, silver prices were as low as 29 cents per ounce, highlighting its volatility yet enduring value.

In more recent history, silver bars gained prominence as investment vehicles. The 1980 silver market spike, driven by the Hunt brothers’ attempt to corner the market, saw prices soar before crashing. Fast forward to 2025, and silver reached an all-time high of $54.47 per ounce, surpassing its 1980 peak and underscoring its potential for significant returns. Brands like Monex have contributed to the legacy of silver bullion bars, blending craftsmanship with investment appeal. Today, physical silver investment, particularly in bars, plays a crucial role in global demand, with countries like India maintaining a tradition of owning silver bars for wealth preservation.

source: SD Bullion

The Modern Appeal of Silver Bars in Investing

What makes silver bars so appealing to modern investors? For starters, they offer affordability compared to other precious metals. With lower premiums over spot price—often just 5-10% for 10 oz bars—silver allows investors to acquire more metal for their money. This makes them ideal for those looking to build a substantial position quickly.

Silver bars also serve as a hedge against inflation and economic downturns. During the 2008 financial crisis, investors flocked to silver ETFs and futures, driving prices higher. In today’s market, with silver topping $53 per ounce, larger bars like 100 oz options are popular for their lasting value and portfolio growth potential. Unlike coins, which may carry collectible premiums, bars appeal to bulk buyers focused on pure metal content.

Additionally, silver’s industrial demand—in electronics, solar panels, and medicine—adds to its investment allure, providing upside potential beyond mere speculation. One-kilo silver bars, for instance, symbolize prosperity and offer tangible wealth preservation. Their liquidity is another draw; well-known bars trade close to spot price and can be sold quickly.

Comparing Silver Bars to Gold Investments

While silver bars shine in accessibility, gold remains a cornerstone of precious metals investing. Gold bars and coins often command higher premiums but provide similar hedging benefits. For those diversifying, combining silver and gold can balance a portfolio. If you’re exploring gold options, Gold Land Merchants Limited positions itself as the largest supplier of pure gold in South America, India, Europe, and Asia, offering products that complement silver investments.

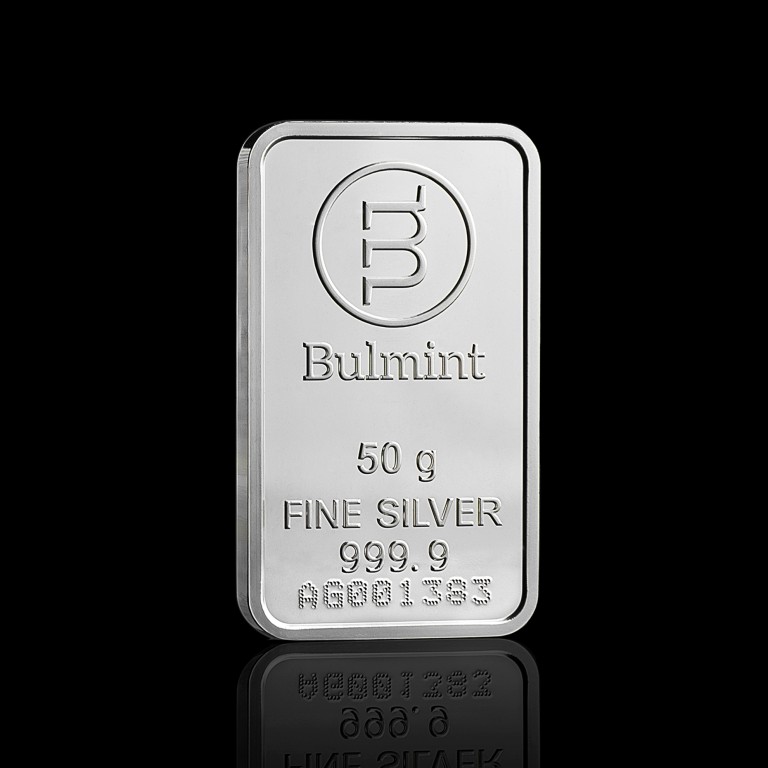

source: Bulmint

How to Start Investing in Silver Bars

Getting started is straightforward. Research reputable dealers, check for purity (at least .999 fineness), and consider storage options like home safes or depositories. Popular sizes include 1 oz, 10 oz, and 100 oz bars, each suiting different investment goals. Always monitor market trends and consult financial advisors to align with your risk tolerance.

Conclusion

Silver bars have evolved from ancient trade tools to modern investment staples, offering history, affordability, and growth potential. As markets continue to fluctuate, their role in diversified portfolios is more relevant than ever.

Silver bars,

Investing in silver,

Silver investment,

History of silver bars,

Silver price history,

Buy silver bars,

Silver bullion,

Precious metals investing,

Silver vs gold,

Modern silver investing,

Appeal of silver bars,

Silver bars for sale,

1 oz silver bars,

Silver market trends,

Physical silver investment.

Leave a comment